INFLATION REDUCTION ACT BENEFITS FOR TINY HOMES

Image courtesy of iStock

INFLATION REDUCTION ACT

United States (U.S.) federal tax credits, through The Congressional Bipartisan Infrastructure Law, commonly referred to as the Inflation Reduction Act (IRA) was signed in to law on August 16, 2022, by President Joe Biden, inaddition to States and local power utilities rebates which provides Americans and domestic manufacturers incentives to make investments in renewable energy and manufacturing. Our research focus will be on the national federal tax credits impact on Tiny Homes since the various states and local power utilities credits and / or rebates; if any, varies by regions.

The precursor of the IRA is the American Recovery and Reinvestment Act, (ARRA), aka The Economics Stimulus Package, was an economic stimulus package enacted by the 111th U.S. Congress and signed in to law by President Barack Obama on February 17, 2009. It developed in response to The Great Recession of 2008. At the time, 8.4 million jobs were lost and 5.7 - 7 million children were living without health insurance. Besides investments in education, infrastructure and healthcare, 90 billion was invested in renewable energy generation, transportation, electric vehicles and the creation of Green Jobs.

The ARRA Investment Tax Credit (ITC) for solar power and the Production Tax Credit (PTC) for wind and other renewable energy forms, along with loan guarantees to support over 40 billion to scale-up renewable energy generation, facilitated development of various clean energy mega projects like the 300 megawatt Agua Caliente solar farm in Arizona; along with the 99 megawatt Granite Reliable Wind Farm in New Hampshire. The IRA would eventually replace the ITC with the Clean Electricity Investment Tax Credit (§ 13702) and the PTC with the Clean Energy Production Tax Credit (§1 3701).

According to Rana Forooher, Global Business Columnist, Financial Times, “Climate Change is a war that we have to win, fighting for a clean energy future requires industrial strategy and that’s not about the market, that is about the state being an actor in the economy and really pushing change that frankly the market has not made in the last 3 or 4 decades.”

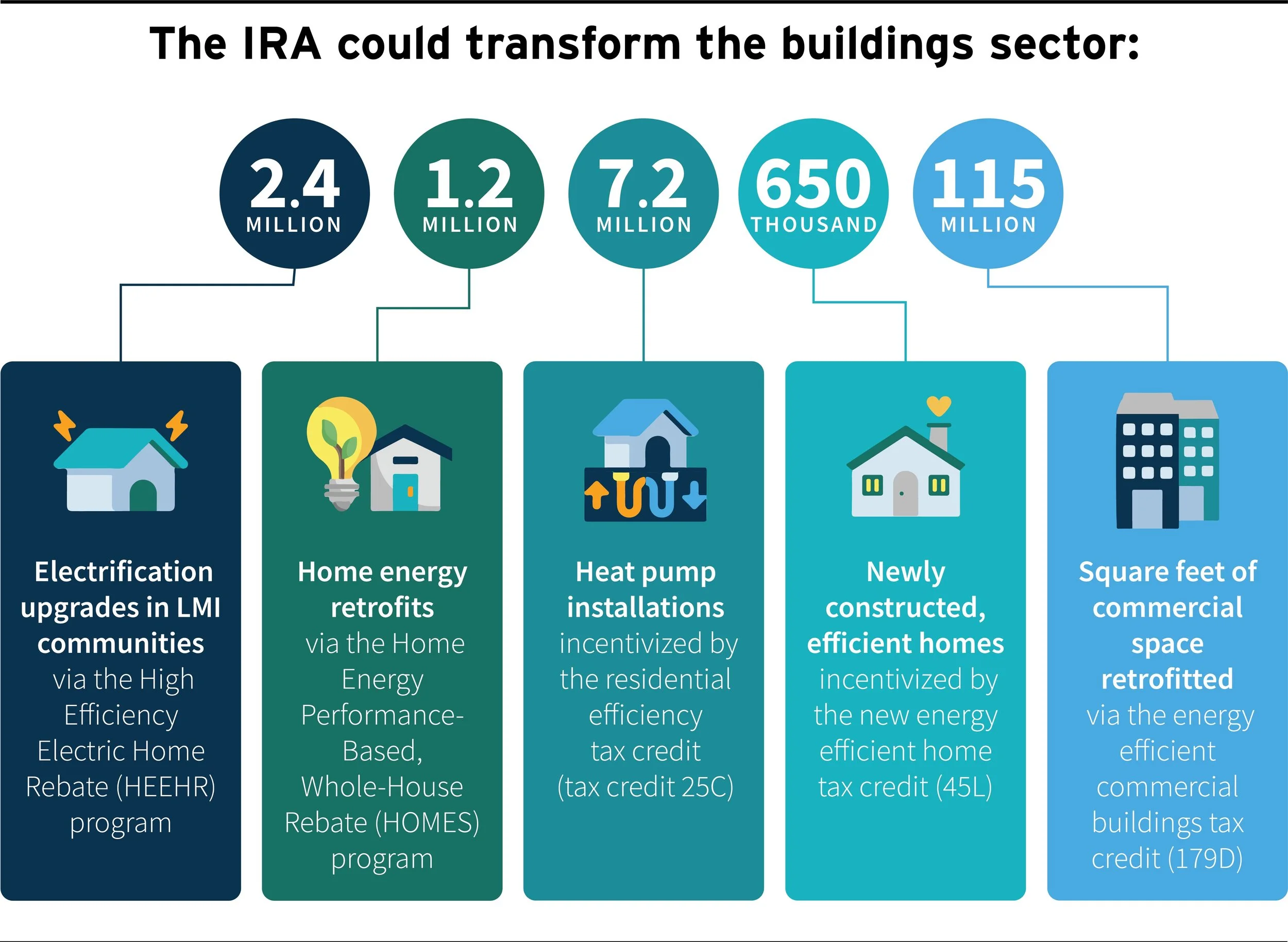

Image courtesy of RMI

FINANCIAL INCENTIVES *

The IRA federal tax credit is not a tax deduction (Refund) or rebate (Cash). The credit offsets the tax liability owed. If the tax filer has no tax liability, no refund or rebate are received.* However, if the tax filer has a tax liability in one year below the credit amount the remaining unused balance of the credit can be used in the subsequent year(s) until depleted. The inverse is if the tax filer tax liability, in one tax year, is greater than the credit the excess will offset the tax liability; depleting the entire credit but reduces the remaining tax liability owed.

Energy efficient Tiny House owners, including standard house or apartment “renters for certain expenditures” are eligible for the same Federal tax credits (IRS Form 5695 Residential Energy Credits), along with States and power utility companies rebates as traditional home owners.

According to The Department of The Treasury, Internal Revenue Service, I Form 5695, “A home is where you lived in 2022 and can include a house, houseboat, mobile home, cooperative apartment, condominium, and a manufactured home that conforms to Federal Manufactured Home Construction and Safety Standards”; commonly referred to as the HUD Code, contained in 24 CFR 3280.

Tiny House owners whom make investments in carbon-free energy production & storage (Qualified: solar, battery storage, small wind turbine, geothermal energy . . . ; along with labor involved for preparation & installation) can receive dividends on their renewable energy investments in the form of a Residential Clean Energy 30% Federal tax credit. The tax credits earned are applied against your Federal tax liability owed. The 30% federal tax credits are available for 2023 - 2032 tax years.

The Federal “Energy Efficient Home Improvement Credit” offers additional credits for investing in energy efficient home improvements (Main home only located in the U.S.). Qualified improvements like exterior doors & windows “that meet or exceed the Version 6.0 Energy Star program requirements”; along with home insulation are “designed to reduce heat loss or gain of your home that meet the prescriptive criteria established by the 2009 IECC.” — International Energy Conservation Code.

Energy efficient heating / cooling equipment like a single or a multi zone Mini Split (Electric Heat Pump) are also eligible for a federal tax credit of 30%, up to $2,000 per year — Valid 01/01/2023 - 12/31/2034. In accordance with Section 25C of the U.S. tax code, only select energy efficient models may qualify. Also, 30% of cost, up to $600 is available for electrical upgrades, including, but not limited to, the main service panel to accommodate installation of a 120 / 240 Volt Mini Split. In addition, States and local power utilities also provide rebates for energy efficient home improvements.

According to the Internal Revenue Service (IRS) Notice 2023 - 38, released on May 12, 2023, the IRA also includes a 10% domestic content tax credit “Adder” to encourage the use of U.S. produced steel, iron and manufactured products mined, produced and manufactured in the U.S. (With the exception of metallurgical processes involving refinement of steel additives do not require domestic production) in renewable energy projects and / or energy storage technologies that qualify for the Production Tax Credit (PTC), Code Section 45 and Investment Tax Credit (ITC), Code Section 48.

In Section 45X , the Advance Manufacturing Tax Credit manufacturers of renewable energy equipment: solar modules, battery storage cells, wind turbines and inverters . . . receive should further lower the cost of production. The Tiny Off Grid House uses solar, wind & hydro energies technology components to produce carbon free energy that can be stored in a lithium battery bank.

The IRA principles of residential renewable energy production and storage, along with home energy efficiency is at the core of the Tiny Off-Grid House sustainable design.

Image courtesy of EFI Foundation

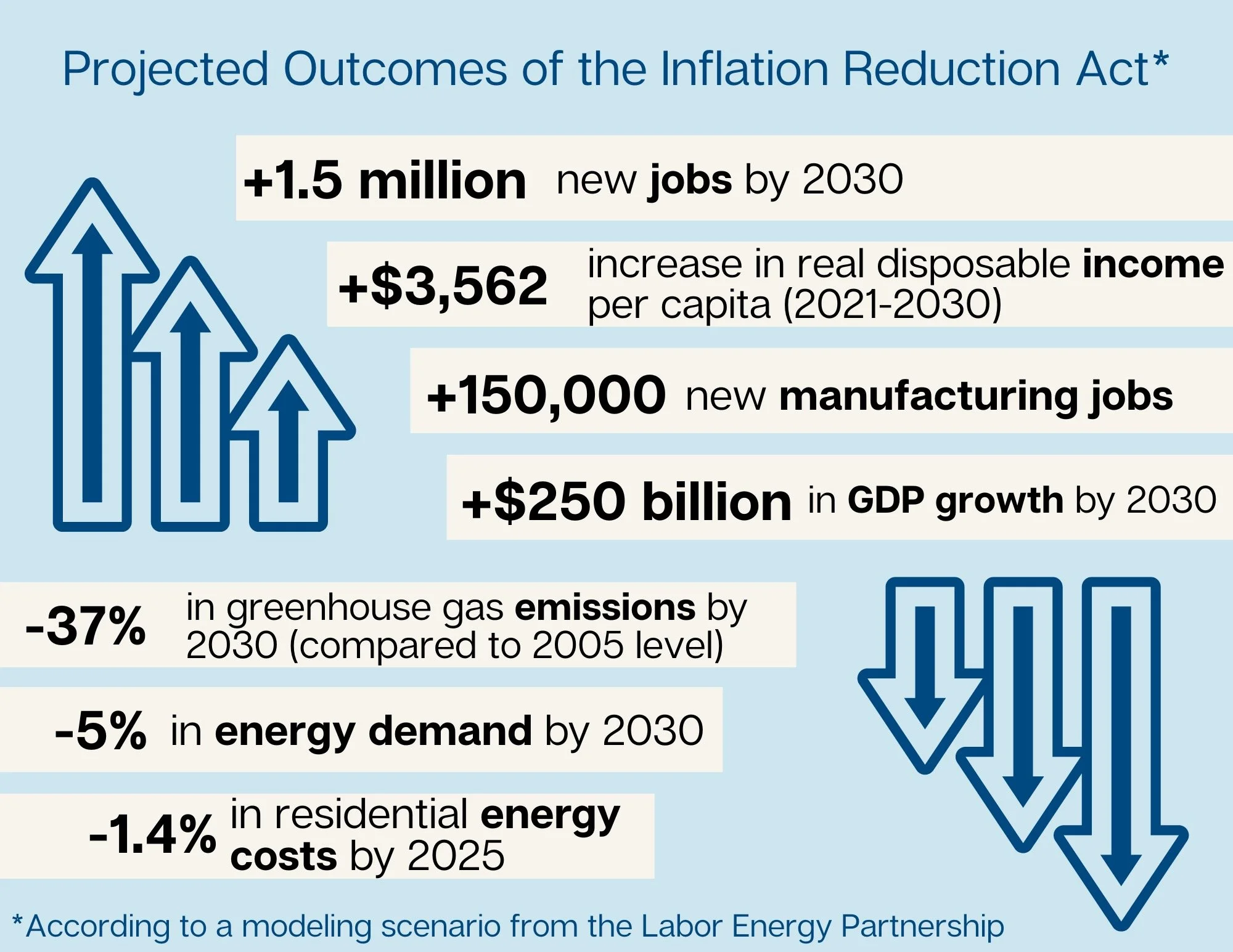

IMPACTS OF THE IRA

The IRA aims to reduce greenhouse gas emissions by 40% below 2005 levels by 2030. According to the White House, “The law will improve public health, reduce pollution, and revitalize communities that are marginalized, underserved, and overburden by pollution while increasing access to affordable and accessible clean energy.”

Just days prior to signing the IRA, President Biden signed in to law The CHIPS And Science Act, aka The CHIPS Act, HR4336., on August 09, 2022. The bipartisan legislation germinated from the insecurity of geopolitics in South East Asia, pandemics and Climate Change related extreme weather events impacting supply chains. The law nurtures “strategic” domestic production of micro-chips with 39 billion towards the construction of semiconductor factories (Fabs) in the U.S. and 13 billion dollars in R & D. American companies like AMD, Nvidia, Apple, Qualcomm and Intel whom may design their own micro chips but outsources manufacturing to a single company, TSMC, in Taiwan. Subsequently, Intel is constructing 2 Fabs in Arizona. Even TSMC is breaking ground on new Fabs in the U.S. The CHIPS And Science Act is expected to generate over 28,00 tech jobs; not to mention, bolster the construction industry with the construction of new Fabs, homes for Workers and new roads . . .

The U.S. economy is projected to strengthen under the Green Nationalism of the IRA & CHIPS Act shifting renewable energy production and supply chains away from globalization and towards the U.S., securing strategic clean energy commodities for energy independence and security.

Since the one-year anniversary of the IRA, it is estimated that over 100,000 new clean energy jobs have been created in the U.S. in trades, including, but not limited to: Electricians, Technicians, Solar Installers, Mechanics, heavy equipment Operators and ancillary staff . . .

* The information provided does not constitute professional tax advice or professional financial guidance. Please consult a tax professional.

Please share your thoughts or experiences in the Comments section below.